retroactive capital gains tax history

There are numerous issues with. And so the Biden administration proposes to increase the capital-gains top rate from 238 percent to 434 percent to pay for its 6 trillion American Families Plan which includes about 18 trillion for child care education and paid employee leave.

Good And Bad News From The Aba Futures Report Perspective Decade Century Aba Bad News

Accordingly there is nothing stopping Congress from passing the Biden tax plan and making the proposed 396 top capital gains rate retroactive to some point earlier this year.

. Indeed we need not look back too far in history to find a. More specifically in August of 1993 Congress passed the Omnibus Budget Reconciliation Act. One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed on the gain from the sale of assets held longer than a year9 President Bidens budget proposal suggested raising the rate on such capital gains to 434 percent for households with income over 1 million effective for all.

Indeed we need not look back too far in history to find a prime example of retroactive tax increases. The Administration leaked. There have been two major increases in the tax rate applicable to long-term capital gains in the past 50 years.

Under a mark-to-market system unrealized capital gains would be taxed on an annual basis just as if they had been realized. The following state regulations pages link to this page. Signed 2 January 2013.

Explanation of the Constitution - from the Congressional Research Service. Then in October President Gerald Ford signed the Tax Reform Act. Retroactive tax provisions in 1969 1987 and 1993 withstood constitutional challenges in part because they were designed to create more taxpayer equity and to eliminate loopholes.

This approach was dropped by the Tax Cuts and Jobs Act of. Completed at any time in 2021. President Biden really is a class warrior.

If the capital-gains rate is increased millionaire and billionaire taxpayers would actually face a 434 tax on capital asset sales when factoring in a 38 tax linked to the Affordable Care Act. Issue Date December 1988. In the Tax Reform Act of 1986 enacted October 22 1986 the tax rate on long-term capital gains was increased from 20 in 1986 to 28 in 1987.

This paper presents a new approach to the taxation of capital gains that eliminates the deferral advantage present under current realization-based systems along with the lock-in effect and tax arbitrage possibilities associated with this deferral advantage. There have been two major increases in the tax rate applicable to long-term capital gains in the past 50 years. Data unavailable for recent years.

Amounts of realized capital gains taxes paid average effective tax rates and maximum tax rate on long-term capital gains for tax years 1954 to 2014. President Biden has been clear that he wants to raise taxes on capital gains for high earners. A historical review suggests that any tax legislation enacted in 2021 could have retroactive effect to transactions.

But until a Wall Street Journal scoop published Thursday night it wasnt known that he wants those taxes raised retroactively. This resulted in a 60 increase in the capital gains tax collected in 1986. But as its Treasury Report makes clear it fears that the steep capital-gains rate increase.

But prior to such legislative change could be subject to a higher capital gains rate. In 1969 during Richard Nixons administration Congress passed the Tax Reform Act of 1969 which raised certain income tax rates with at least twenty retroactive effective dates. In the Tax Reform Act of 1986 enacted October 22 1986 the tax rate on long-term capital gains was increased from 20 in 1986 to 28 in 1987.

This resulted in a 60 increase in the capital gains tax collected in 1986. If the capital-gains rate is increased millionaire and billionaire taxpayers would actually face a 434 tax on capital asset sales when factoring in a 38 tax linked to the Affordable Care Act. One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed on the gain from the sale of assets held longer than a year9 President Bidens budget proposal suggested raising the rate on such capital gains to 434 percent for households with income over 1 million effective for all sales on or after April 2021.

Not only does he want to raise taxes on capital gains to a modern high of 434 he wants to do it retroactively. In recent years such retroactive rate changes have occurred as late into the year. This isnt a judgment on the merits or demerits of raising top capital gains rates either to Bidens preferred 396.

Made permanent the capital gains rate changes in the JGTRRA but provided for a maximum rate of 20 percent. The new approach also taxes capital gains only upon realization but by effectively charging. Historical Capital Gains and Taxes.

While the most significant recent capital gains rate change provided by the JGTRRA was largely. Under the rules then in effect they had to pay tax on only half that amount. The 1987 capital gains tax collections were.

Effective for taxable years beginning after 31 December 2012 ie. From 1998 through 2017 tax law keyed the tax rate for long-term capital gains to the taxpayers tax bracket for ordinary income and set forth a lower rate for the capital gains.

Biden Wants To Limit The Capital Gains Tax Preference History Shows It Will Be Hard

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Managing Tax Rate Uncertainty Russell Investments

A New Era In Death And Estate Taxes

Managing Tax Rate Uncertainty Russell Investments

The Economic Impact Of Tax Changes 1920 1939 Cato Institute

Tax Reform Uncertainty Leaves Taxpayers With Questions Fi3 Advisors

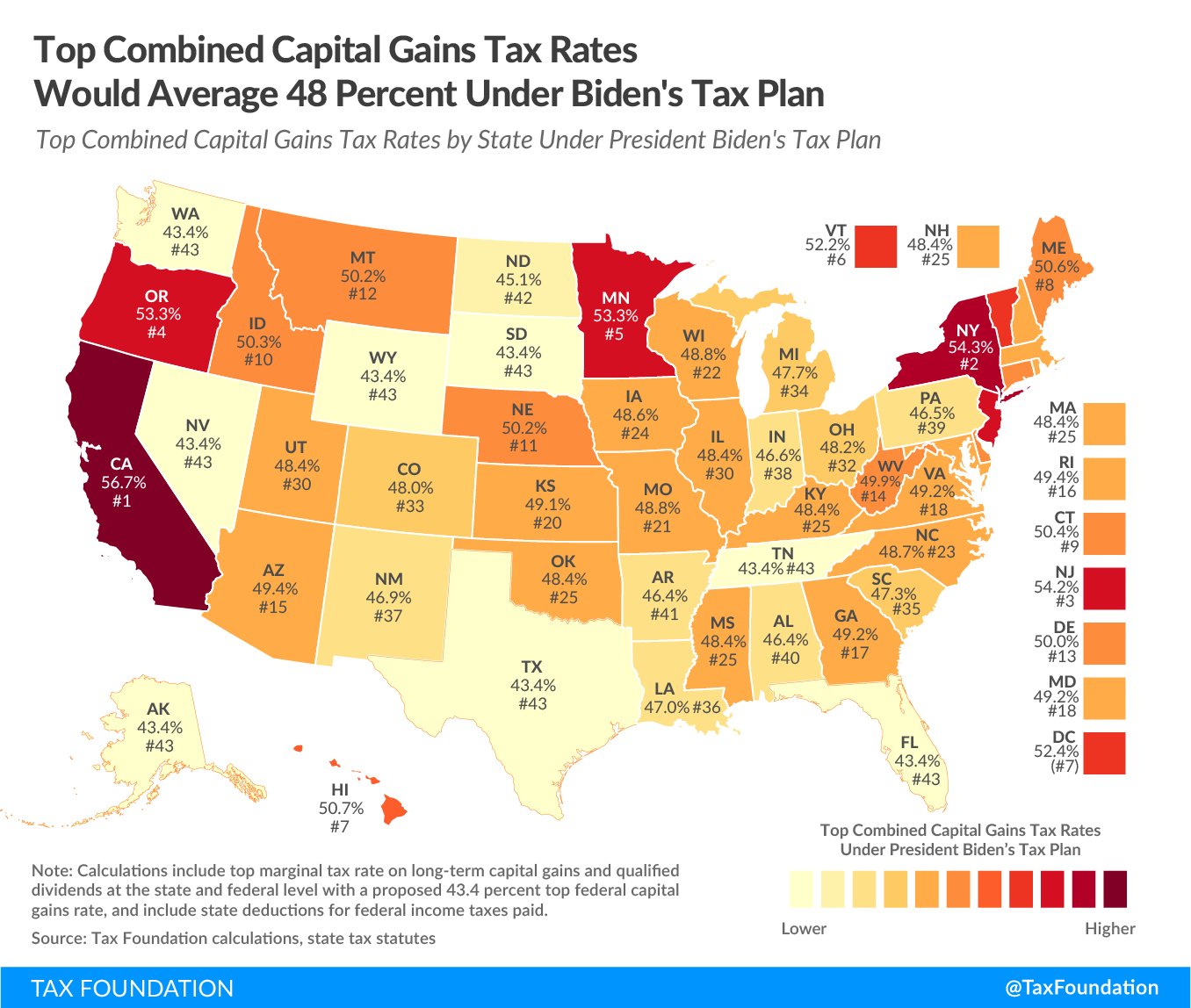

Tax Foundation On Twitter Under President Biden S Tax Plan 13 States And D C Would Have A Top Combined Capital Gains Tax Rate At Or Above 50 56 7 Ca 54 3 Ny 54 2 Nj

Potential Changes To The Capital Gains Tax Rate Publications Foley Lardner Llp

Tax Increases Are Coming Or Are They Bny Mellon Wealth Management

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea

Doing Business In The United States Federal Tax Issues Pwc

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

.png)

Biden S Green Book Includes Retroactive Capital Gains Tax Increase Husch Blackwell Llp Jdsupra

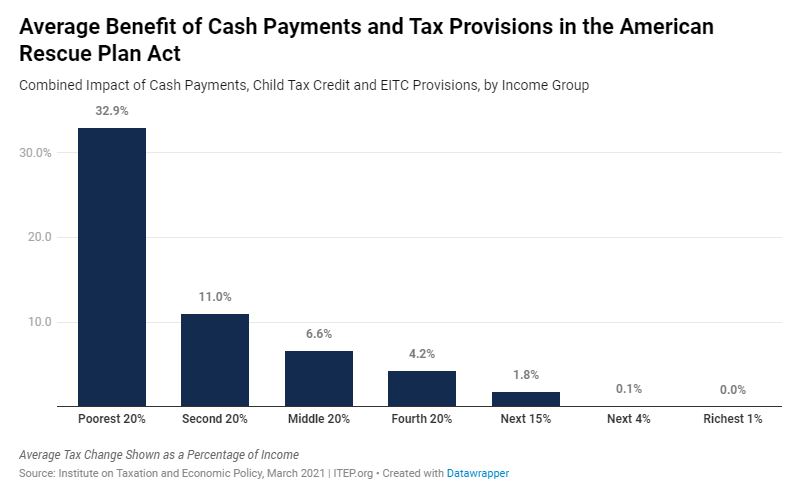

Covid 19 Tax Policy Resources Itep

The Economic Impact Of Tax Changes 1920 1939 Cato Institute

How To Help Your Real Estate Investor Clients Structure Their Businesses Accounting Today In 2021 Real Estate Investor Real Estate Investors

Biden Tax Plan And 2020 Year End Planning Opportunities

Higher Us Capital Gains Tax Proposal Spurs Pe M A Rush S P Global Market Intelligence